The $2.5 Billion Blind Spot in Your Alternative Assets Strategy

- 7 hours ago

- 4 min read

Women's sports pulled in $2.5 billion in 2025 still just 3% of the $75 billion sports industry. But here's what matters: that gap is closing fast, and the investors who move now are positioning themselves ahead of a market correction decades in the making.

Lorine Pendleton saw it four years ago. As founder of 125 Ventures and a NYC Chair at TIGER 21 groups (peer networks for ultra-high-net-worth individuals and family offices).

They were wrong. The data proves it. Now there is a fundamental shift happening in sports with the rise of women’s sports.

The Momentum Backed by Data

Caitlin Clark’s 2024 NCAA title game drew ~18.9M viewers, making it the most-watched basketball game at any level since 2019. New York Liberty games routinely sell out.

On Jan. 30, 2026, Unrivaled’s Philadelphia tour stop at Xfinity Mobile Arena drew 21,490 fans, the largest crowd ever for a regular-season professional women’s basketball game, and the highest-attended event in the arena’s history.

Merchandising is up 600%.

Media valuations are exploding.

"We're in the early innings, and that window to invest is closing." Pendleton explains.

The infrastructure is beginning to catch up to the fanbase. Title IX, equal pay advocacy, and digital media revealing athlete personalities have built an ecosystem that's ready. What's changed? The capital is arriving.

Sports as an Alternative Asset Class

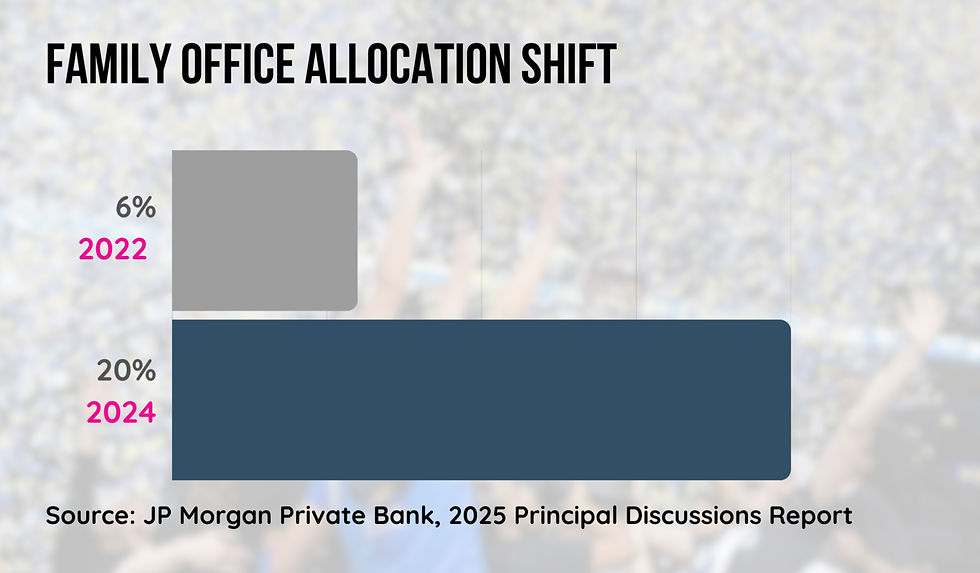

J.P. Morgan Private Bank’s 2025 Principal Discussions Report (interviews with 111 billionaire-family principals) found that 20% now own controlling stakes in sports teams, up from 6% in 2022. This sharp shift signals sports is moving from “trophy asset” to intentional portfolio allocation.

"Sports were seen as trophy assets, buy a team, take your buddies to games," Pendleton says. "Now it's serious business."

The NFL has outperformed the S&P 500 historically and grown 600% as a league. Private equity firms are entering: the NFL recently opened ownership stakes to 10 select PE firms. Sports assets are uncorrelated with traditional markets, when the economy struggles, people still watch, still escape, still root for their teams.

This is where it gets interesting for early movers:

Women's sports offer earlier-stage entry points than saturated men's leagues.

Case Studies

Angel City FC went from a $3 million valuation to selling a controlling stake for $250 million in three years. Bob Iger (Disney CEO) and Willow Bay bought in sending a signal that media and entertainment veterans see upside.

The New York Liberty is now valued at $425 million. When the Tsai family bought the Brooklyn Nets, the Liberty was bundled in for roughly $25 million. Today, games sell out. Celebrities fill courtside seats.

San Diego Wave sold for $130 million. Compare that to the Lakers selling for $10 billion. Women's sports offers comparable growth trajectories at accessible entry points.

Why Now?

Pendleton is watching capital flow in for three reasons:

Patient capital alignment. Family offices invest for the long term. Sports assets match that horizon. They're illiquid, yes, but appreciation curves are steep.

Generational appeal. Next-gen heirs want in. Sports investing offers engagement, impact, and returns. It’s a trifecta for families thinking multi-generationally.

Diversification. Sports don't move with tech crashes or rate hikes. They move with culture, fandom, and media rights - different risk profiles entirely.

This is exactly why Julie Castro Abrams and How Women Invest have been spotlighting women's sports. It's a fundamental market realignment (explore more in our analysis here).

How to Enter This Market

Pendleton lays out the landscape:

Path One - Direct team ownership.

You can buy in directly, but it's capital-intensive. Established WNBA or NWSL franchises are out of reach for most allocators. Emerging leagues such as professional women's hockey, flag football, volleyball, softball, rugby offer more accessible entry points, with valuations still in the $20-100M range.

Path Two - Sports tech and infrastructure.

This is where the momentum is accelerating. Rather than waiting for team valuations to mature and access investments in teams, you're betting on the platforms, wearables, and analytics that power the entire ecosystem. You’re investing where sports, media, and entertainment become technology businesses.

The capital is already flowing: Bruin Capital just closed a $1 billion fund focused entirely on sports tech. Two activity trackers - Strava filed for an IPO, and Oura raised at a $11 billion valuation.

There is an opportunity for an IPO or M&A exit in 2-4 years (vs. 7-10 years for teams), with more predictable liquidity paths, smaller ticket sizes, and shorter hold periods.

Uncorrelated Returns and a Narrowing Entry Point

Women's sports sit at the intersection of undervalued assets, cultural momentum, and institutional validation. The $124 trillion wealth transfer to women through 2048 adds tailwinds: capital allocators who historically allocated 3% to women's sports are being replaced by allocators who see the gap as an opportunity.

"Don't think too hard," Pendleton warns. "That window is closing."

For asset managers, family offices, and LPs evaluating first-time sports funds, the thesis is this: women's sports offers early-stage entry into a legitimate asset class with uncorrelated returns, patient capital timelines, and explosive growth trajectories

Ready to explore women's sports investing?

Join Lorine Pendleton, Tuti Scott, and many other industry leaders at the Investing in Women's Sports Symposium on February 19, 2026, in New York City. Hear from fund managers (125 Ventures, Tipt Ventures, How Women Invest, Monarch Collective), LP perspectives, and founders building the ecosystem.

Want insights like this in your inbox? Subscribe to our newsletter for research-backed perspectives on alternative assets, emerging markets, and where smart capital is moving next.